Financial markets law – the new climate-related disclosures regime (new Westlaw New Zealand)

Objectives and vehicles for legislative change

The Financial Sector (Climate-related Disclosures and Other Matters) Amendment Act 2021 amends the Financial Markets Conduct Act 2013 (FMCA), the Financial Reporting Act 2013 and the Public Audit Act 2001.

Under the changes it will be a requirement for certain climate reporting entities (CREs) to disclose reliable information about climate-related risk (see the new pt 7A of the FMCA).

The FMA says the aim of the legislation is:

- to ensure that the effects of climate change are routinely considered in business, investment, lending, and insurance underwriting decisions; and

- to help CREs better demonstrate responsibility and foresight in their consideration of climate issues; and

- to lead to smarter, more efficient allocation of capital, and help smooth the transition to a more sustainable, low-emissions economy.

Who will be required to comply?

Certain CREs will be required to meet the new disclosure requirement. The term “climate reporting entities” is defined in the new ss 461O to 461S of the FMCA and covers:

- large listed issuers (market capitalisation exceeding $60 million);

- large banks, licensed insurers, credit unions and building societies (assets exceeding $1 billion or gross premium revenue (including subsidiaries) exceeding $250m);

- large managers of registered management investment schemes (total assets exceeding $1 billion).

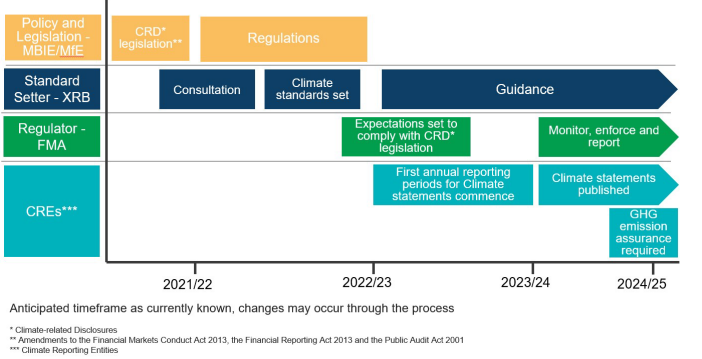

Implementation timeline

There are three phases to commencement of this legislation:

1. Immediate change - Financial Reporting Act 2013:

- functions and responsibilities of the External Reporting Board (XRB) under a new regime put in place

- introduction of climate standards (consultation on standards required)

2. By Order in Council within 12 months of date of Royal assent (so before 27 October 2022):

- changes to the FMCA, requiring climate related disclosure for certain Financial Markets Conduct reporting entities

3. By Order in Council by third anniversary of the date of Royal assent (so before 27 October 2024):

- requirements for assurance of climate statement relating to greenhouse gas emission disclosures.

How does the implementation timeline work in practice?

The FMA has provided the following graphic that sets out the process for each of the three phases:

FMA guidance on implementation of the climate-related disclosure regime

The FMA published its implementation approach guidance document on 17 November 2021: Financial Markets Authority Climate-related Disclosures regime: implementation approach (November 2021).

For full details on the timeframes for consultation and implementation see the FMA document.

Thomson Reuters' commentary on the FMCA in Financial Markets Law on Westlaw New Zealand will be updated progressively to reflect and explain changes in the law.